A quick question: Did you sell out of your entire inventory before Christmas? Neither did I. During Q4, many Amazon sellers get used to the abundance of sales that come with the Christmas season. Actually, we get spoiled with so many sales per day that when January arrives, we get scared. All of a sudden the sales seem to stop, and for some sellers panic sets in. Some sellers think that the answer is to lower their prices ASAP in hopes of getting more sales, but is that really the answer?

One of the things I always try to remind people is patience brings profit. It’s true that sales in January are usually not as good as December, but they still can be outstanding. The question I want to ask you is this: What is your business model when it comes to selling on Amazon? If you have a model that is focused on fast turns (items that sell very quickly once they arrive at a FBA warehouse) then you will price items much differently than if you have a business model based on patience.

I sometimes hear about Amazon sellers stating they lost money on an item they purchased in the fall and were hoping to sell during the Christmas selling season. The items didn’t sell out and now the price has tanked. Sometimes the price has fallen so far that the current price on Amazon is lower than the price they paid for it back in the fall. This can be frustrating for any seller. So what is the answer?

If your business model is based on fast turns, then you might want to lower your price (even if you lose most of your money) so that you can get some of that capital back to reinvest in items that you think will bring a better and faster return. On the other hand, if you are patient, you might just see the price you want return to equilibrium and wind up making a profit. Since monthly FBA storage fees are usually around a few pennies per month per item, it would seem to me that patience could possibly pay off in the end.

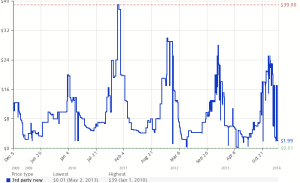

I’ve seen it happen often: An item is selling for a great price in December, but then falls drastically in January. A few months later, the price begins to rise again, and in December the price is back up where the profit margins are the best. Does this happen 100% of the time? No, but it happens enough that the few cents per month to pay for the item to sit in an Amazon FBA warehouse might be worth the gamble. Look at the image above. Almost all year long, the prices are low, but when Q4 approaches, the prices shoot up.

I’ve seen it happen often: An item is selling for a great price in December, but then falls drastically in January. A few months later, the price begins to rise again, and in December the price is back up where the profit margins are the best. Does this happen 100% of the time? No, but it happens enough that the few cents per month to pay for the item to sit in an Amazon FBA warehouse might be worth the gamble. Look at the image above. Almost all year long, the prices are low, but when Q4 approaches, the prices shoot up.

Sometimes, it’s better to have $50 five months from now than $5 today. Why? Because I adhere to the balanced business model. I try to stock my inventory with slow dimes, fast nickels, and super slow quarters. What does this mean? It means that my inventory is loaded with items that will sell fast, sell slow, and sell super slow. I’m ok with making a 30-50% ROI (Return On Investment) on the items that sell fast. On items that sell slower, I want to get at least 100% ROI, and for the items that sell super slowly (think long tail items), I want the ROI to be well above 200%. The waiting game isn’t always fun, but in this balanced business model, patience brings profit.

Sometimes, it’s better to have $50 five months from now than $5 today. Why? Because I adhere to the balanced business model. I try to stock my inventory with slow dimes, fast nickels, and super slow quarters. What does this mean? It means that my inventory is loaded with items that will sell fast, sell slow, and sell super slow. I’m ok with making a 30-50% ROI (Return On Investment) on the items that sell fast. On items that sell slower, I want to get at least 100% ROI, and for the items that sell super slowly (think long tail items), I want the ROI to be well above 200%. The waiting game isn’t always fun, but in this balanced business model, patience brings profit.

I don’t want to wait 11 months if the ROI isn’t high enough. It all comes down to opportunity costs. The longer I have to wait to sell an item at a higher price, the higher the potential ROI needs to be.

If I hold my higher price, I could sell it later and get more for my item… but if I lower the price and sell sooner, I could reinvest that capital into items that will sell much faster. Each item is different and will require a different pricing strategy. Sometimes it’s good to hold at your higher price, because you’ve seen on Keepa that in a few months, that item will probably be selling at the higher price you have it listed at. On the other hand, if you’ve seen the Keepa data and it looks like the price will not recover soon enough, then it’s a better idea to lower your price so you can get that capital back to invest in better inventory.

If I hold my higher price, I could sell it later and get more for my item… but if I lower the price and sell sooner, I could reinvest that capital into items that will sell much faster. Each item is different and will require a different pricing strategy. Sometimes it’s good to hold at your higher price, because you’ve seen on Keepa that in a few months, that item will probably be selling at the higher price you have it listed at. On the other hand, if you’ve seen the Keepa data and it looks like the price will not recover soon enough, then it’s a better idea to lower your price so you can get that capital back to invest in better inventory.

Bonus Tip: If you have multiple quantities of a particular product that hasn’t been selling and suddenly begins to sell, check to see if you need to raise the price. You don’t want to raise it so high that it won’t sell again, but raise it up enough to match everyone else’s price. If the items stop selling, you can always lower the price back to where it was.

So what about you? What works best for your business? Would you rather get your capital back to reinvest, or do you wait for the prices to return to what you’d like them to be?

*This article was originally written in 2014 but has been updated for January 2016

Well, thank goodness! Finally a hint of sanity amongst the madness. I definitely use the balanced business model and it has served me very well. Perhaps, though I am the lucky one, because I have been well-funded from the beginning and haven’t “needed” to drop my prices to compete. Others are working with different constraints, and I understand that.

But I still contend: the money is made when buying, and going into a panic and throwing profit out, simply because “I must turn this TODAY” is not conducive to a positive balance at the end of the year.

Well said, Georgene!

Retail Arbitrage, i’m agree with you.

I agree with your balanced approach. It’s great to have longer tail items as they can help fund the times when you are not actively buying as much new inventory as other times of the year.

If you don’t mind sharing, what items is the camelcamelcamel chart above from?

Ryan, I’m actually keeping this item to myself. It’s an item I buy often during the summer months, and sell during Q4. I’ll actually be writing up a blog post about my Amazon Arbitrage methods sometime soon.

Sounds great, I look forward to reading that!

Great advise. I’m actually searching for “tanked” prices on several games that I sold well during Q4. Data shows they have done well on several Q4 periods in a row. I have every reason to believe they’ll do it again next fall. We just started last March so this was our 1st Q4. We approached it very conservatively this year. Thankfully, I’m seeing my used book sales picking back up this past week.

Yes! That’s a great strategy, and one I use often… I LOVE to buy items on amazon when the price tanks, and then price them to sell for Q4. That is a key part of my balanced approach. I especially love using that method with board games.

Great post! I was thinking about this and your post eased my mind. I’m a new seller and working on creating a balanced plan! Lot’s to learn!

Thanks for the post!

Glad this post was helpful! Balanced is best… and I wish you nothing but success!

I agree about the Q4 hangover from my first year. I would like to ask about the “long term storage fees” and if/how you figure that into your costs? My first few items purchased are coming up and Amazon emailed saying I would be charged $111 for 61 items if they did not sell before Feb 15th. The inventory is mostly stuff I bought when first starting so the margin is not great. I have definitely done better and agree with the comment about the profit being in the purchase. That is my business model (patience= profit in my book). I have not had to deal with long term fees and I guess it will balance out a bit when storage fees go back down, but have fallen into the “must sell even at a loss” if the long term fees are greater than keeping in my inventory. Interested in your thoughts and thanks for this forum!

Michael, I have a blog post all about aged inventory (right here: http://www.fulltimefba.com/aged-inventory) that should answer your question. Let me know if you have any other questions about this topic.

Thank you for the link. It helped me see which items I need to get rid of fast or remove to save a lot of money! I might end up trying the suggestion about sending them back in again after Feb 15th =) They are actually summer products so might sell quicker. I appreciate your blog and taking the time to educate/share with all of us.

You’re welcome! Glad this post was helpful!

I’ve been doing what your aged inventory article suggests and am only lowering prices (some of which are “tanked” unfortunately) to avoid the LTSF but only if it makes more sense than actually just paying the fee.

This is good advice, Stephen, and applies also to private-labeled products where you don’t have competition on your specific listing. It pays to keep an eye on your competitors with similar listings as well as they can be snagging some of your market share. Pricing is an art form but you are spot on that it is important to know what your business model and goals are before wildly changing prices.

I stopped using the retail arbitrage method because it made me crazy to get in on a product only to find that Amazon joined the party on that listing after sending in my inventory. I also had a hard time not participating in the race to the bottom in an effort to win the buy box. Finally, advertising on Amazon’s platform only works if you’re in the buy box so it’s as if they are encouraging the race-to-the-bottom mentality.

Private labeling works best for my personality!

Good to hear you found what works best for you! And I’m glad you can apply this blog post to your situation.

If the only way to make buying decision on slow seller or seasonal seller is analyzing sales history on CCC then what if that history is unavailable or it shows steady decline in product’s price?

Steady decline is not always bad and it often means that there’s newer model available and current is discontinued. But not everything that is newer is better and I once found that item I sold at okay price is now discontinued and price very high, having demand as well.

I agree with balanced approach but this required knowing your inventory and without repricing plan and automated software I am not clear how you can maximize the profits from your balanced approach if you sell many SKUs which I assume you do as you are full-time in it.

If the history is unavailable then either the product is somewhat new, and therefore has not been added my CCC to track, or it’s been so long since someone has wanted to see data on that product, that CCC deleted the past data since they noticed no body was interested in seeing it for so long. There are other reasons why an item might not have CCC data, but those are the main ones I know of.

Another way to guess if an item is a good seller is to look at recent reviews. If the item has many recent reviews, then it’s safe to say it’s been selling recently. Other than that, the best thing you can do is make an educated guess.

Full-time FBA = Cool head FBA

Good post!

Hey, how do I make my picture show up with my post?

Allen, I think only people with wordpress blogs can upload a picture to go with their comments. I may be wrong.

Hi, Stephen. Thanks for this post. It’s something I have to remember often when I feel that “panic” feeling as I see prices tanking. Something I wanted to mention from my experience regarding toys is that many times I have held on toys for the prices to recover and they only go lower and lower and seem to never recover. Toys is one category that seems fickle in this way. However, last year I resisted selling when the prices were so low and found out that they will recover many times in Q4. Q4 is magical, in my eyes, especially when it comes to toys!

What are your thoughts on Christmas-specific items, such as stockings and ornaments, that don’t sell? I have some ornaments that, for a reason I still cannot get from Amazon, sat inactive in my inventory, but received in the warehouse for over 2 1/2 weeks. Needless to say, I still have quite a few in my inventory. Do I just leave them there until next December or tank the price and get rid of them? We’re not talking about a lot of cost to me…I paid perhaps $100 for the items.

It depends on how many you have in stock, as you’ll be charged long term storage fees in August for those still in a FBA warehouse at that time. I’ve still sold Christmas things throughout the year… especially around the time people have “Christmas in July” parties. Check Keepa and see if the price recovers well before Christmas of next year. I wish you the best!

Just had a game sell that had a price drop after Christmas. (It’s now March 24 for anyone that might find this later.) We’ve just been waiting for the prices to rise and they did. We also bought several new games from Amazon MF sellers during the post Christmas drop that we’ll sell later this year for a substantial mark up.

Awesome!!!!